With the allure of quick profits, many people see the stock market as a pathway to wealth. But it’s a double-edged sword. Deep inside, it hides a labyrinth of risks many investors are unaware of – manipulation, investment fraud, and dark forces.

That’s why we decided to uncover some of the most shocking facts about the stock market that every investor needs to know to stay ahead of the game.

Today’s Focus of Attention is reader-supported. We sometimes include products we think are useful for our readers. If you buy through links on this page, we may earn a small commission.

Market Manipulation is More Common Than You Think

Tricking the market is not a relic of a bygone era. Still today, traders and scammers use tactics like pump-and-dump schemes, spoofing, layering, and high-frequency trading (HFT) to affect stock prices. Let’s review each of them.

What is the Pump-and-Dump Scheme?

This is a type of securities fraud that artificially inflates the price of a stock. Perpetrators then sell their holdings at a higher rate, leaving unsuspected investors with losses when the price crashes. Here’s how it works:

The Pump

Scammers target low-priced and thinly traded stocks (penny or micro-cap); they are easy to manipulate because of their lower trading volume and liquidity.

Next, the wrongdoers spread false positive information about the stock through social media fake accounts, online forums, or spam email campaigns.

And even hire individuals to give the impression of widespread optimistic sentiment.

The Dump

As more people believe the hype and buy into the stock, demand increases, driving up the price.

Once on a desirable level, the scammers sell their own shares (gained at a lower value beforehand) and make significant profits.

With the perpetrators gone, the artificial hype fades, and the stock price plummets, creating substantial losses on investors.

How to Protect Yourself in the Stock Market

- Be wary of “too good to be true” offers and be sceptical of unsolicited investment advice, especially if it promises guaranteed returns.

- Analyse companies before investing, observing their financials and news from credible sources.

- Pay attention to excessive promotion.

- If you suspect a pump-and-dump scheme, report it to the Securities and Exchange Commission (SEC) in the US, the Financial Conduct Authority (FCA) in the UK, or the European Securities and Markets Authority (ESMA) in the EU.

What is Spoofing?

Imagine a phantom creating illusions to deceive viewers. Spoofers place large buy or sell orders for a security with no intention of executing them. The aim is to create a false impression of supply or demand, tricking traders into believing the price is moving in a certain direction.

Example of Spoofing

Let’s say a stock is trading at $50. A spoofer places a huge sell order for 10,000 shares at $49.90, making it appear as though someone is desperate to take money off the table. Seeing this, other traders might panic and start selling too, pushing the price down.

Once the value drops to $48, for instance, the spoofer cancels their original sell instruction and buys the stock at the lowest cost.

How Spoofing Impacts Markets

- This practice erodes trust and undermines integrity in the securities field since it relies on deception and creates an uneven playing field.

- Injecting unnecessary volatility, harming genuine investors who may decide based on fake signals.

What is Layering?

Similar to spoofing, layering is an illegal tactic used to create a false impression of supply and demand. Here’s a breakdown:

| Building the Layers | A trader places a plethora of buy or sell orders at different price levels, but with no intention of executing them. |

| Creating an Illusion | These layered instructions give the impression of increased buying or selling interest, deceiving other traders into believing the price is changing. |

| The Bait and Switch | If enough prey cross the path, the perpetrator places a genuine order on the opposite side to capitalise on the artificial price movement he’s orchestrated. |

Example of Layering

Consider a stock trading at $10. Criminals place multiple sell orders below the market price (1,000 shares at $9.98, another 1,000 at $9.96, and more at lower prices). This creates a facade of selling pressure.

Other investors assume negative news is coming. So, they put on sale their own holdings, hammering the price.

Following, the lawbreaker, seeing the valuation fall as intended, cancels all his sell orders and rushes to buy as many shares as possible at the artificially lowered rate.

Key Difference Between Spoofing and Layering

While both are illegal, spoofing involves placing a single large order and quickly cancelling it, whereas layering relies on submitting multiple transactions at different price levels to create an illusion.

What is High-Frequency Trading (HFT)?

High-Frequency Trading uses powerful computers to execute a massive number of orders at flying speeds, exploiting fleeting market inefficiencies.

Here’s How HFT Works

| Tech Investment | HFT firms invest in technology and infrastructure to gain a millisecond advantage in trade execution. |

| Algorithmic Analysis | Their sophisticated algorithms analyse data, identify opportunities, and automate trades. |

| Common Strategies | These include:

|

Benefits of High-Frequency Trading

| It can improve liquidity by granting countless exchange orders. |

| Increased competition leads to narrower bid-ask spreads, reducing transaction costs. |

| In theory, it enhances market efficiency by rapidly arbitraging away price discrepancies, reflecting information in prices faster. |

Drawbacks of High-Frequency Trading

| HFT has the capacity to increase volatility, often during periods of stress. |

| Strategies such as ‘front-running’ or ‘quote stuffing’ have been accused of being predatory. |

| Concerns are raised about its potential to amplify crashes or exacerbate systemic risks due to its speed and interconnectedness. |

Is High-Frequency Trading Legal?

This is where the line gets blurred. Unlike spoofing and layering, clearly illegal, HFT is a valid strategy as long as it operates within the boundaries of existing regulations.

The Grey Areas

Determining whether an algorithm is engaging in legitimate or manipulative market making can be tricky. HFT technologies and strategies advance faster than regulators create clear rules for what’s allowed and what’s not.

To avoid abuse, some jurisdictions have implemented controls, including curbing excessive order cancellations or halting dealings during periods of extreme volatility to prevent crashes.

Are Pump-and-Dump, Spoofing, and Layering Still Catching Prey in 2025?

Despite advancements in regulations, I’m afraid so. Here’s why:

- Cryptocurrency, decentralised finance (DeFi), and online trading platforms have opened new windows for deceit.

- Fraudsters are getting better at lying, using social media, and targeting different investors.

- Manipulation occurs across borders, becoming frustrating for authorities in one country to pursue bad actors operating from another.

How to Stay Vigilant

- Be sceptical of guaranteed returns and extraordinary claims.

- Don’t rely only on social media or online forums. Consult reputable sources, read company filings, and seek expert advice.

- Be aware of sudden price spikes without evident news backing them.

Insider Trading

Insider trading occurs when someone trades securities (stocks, bonds, etc.) based on confidential information she’s obtained because of her position or relationship with a company.

Example of Insider Trading

Imagine an executive learning that an upcoming merger is going to boost her company’s stock price. If she buys a bunch of shares before that news is made public, she will profit from data not available to external investors.

Is Insider Trading Legal?

This practice is illegal in the United States, the UK, and the European Union. Why? Simply because it creates an uneven playing field, as insiders have access to statistics, independent investors don’t. Also, it undermines the integrity of financial markets, since venture capitalists lose confidence when they perceive someone with confidential knowledge is manipulating the system.

Past Performance is Not Indicative of Future Results: Debunking the Myth of Predictability

A common misconception is that a well-performing stock will always follow a similar script. Countless factors influence securities prices, including economic trends, geopolitical events, or company-specific news.

So, relying only on past performance is a recipe for potential disaster.

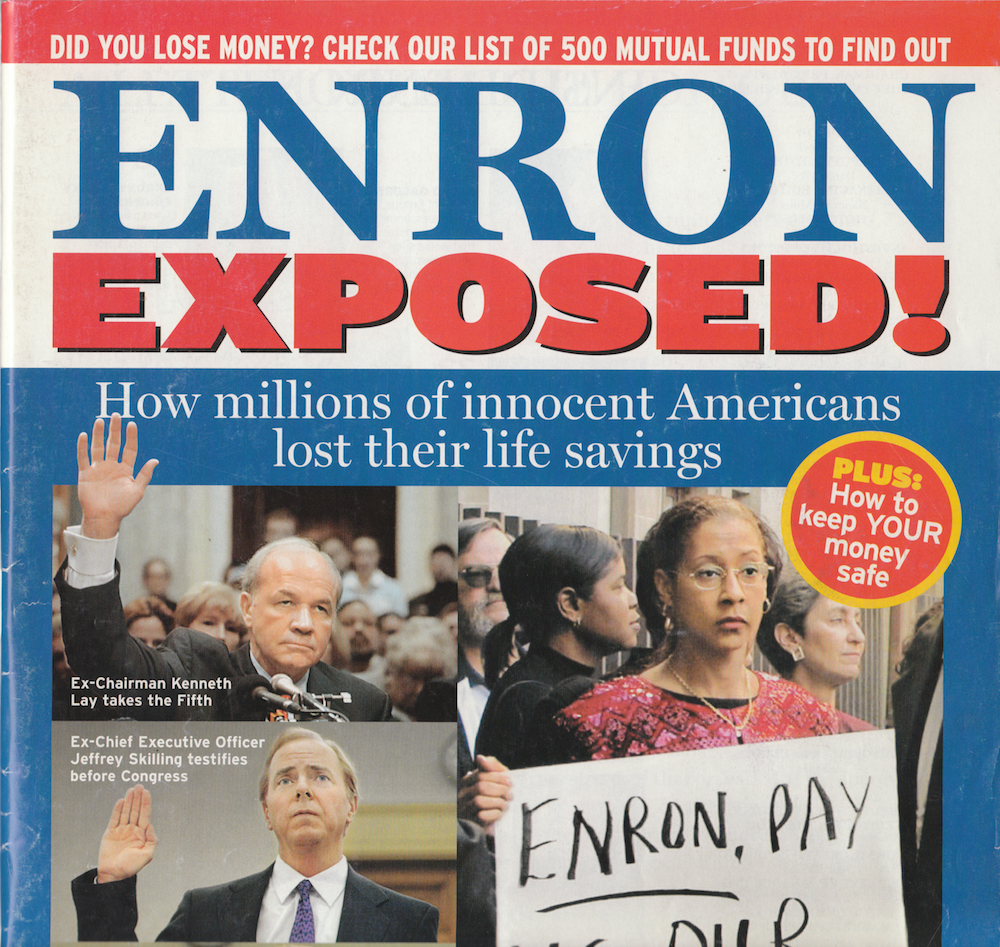

Example 1: Enron Scandal

You might recall the rise and fall of Enron Corporation in the late 1990s and early 2000s.

Enron, an energy giant, saw its stock price soar and was hailed as revolutionary for its innovative business practices and consistent, strong earnings growth.

This company attracted investors from all walks of life, eager to cash in on its seemingly unstoppable ascent. And executives aligned every fibre of their beings to keep the facade of prosperity by any means necessary.

The House of Cards Crumbles

In the real world, Enron’s success stemmed from a foundation of accounting fraud. The firm used complex schemes to hide billions of dollars in debt and inflate its earnings.

When the scheme was unmasked in late 2001, Enron’s stock price plummeted from a high of over $90 per share to less than $1 within a matter of weeks.

Venture capitalists lost billions and saw their savings wiped out overnight.

Insider Trading Role in Enron’s Downfall

As Enron’s financial condition worsened, executives engaged in insider selling by unloading huge amounts of their stocks while simultaneously promoting the company’s value.

One of the worst individuals, Kenneth Lay, Enron’s CEO, sold millions of dollars’ worth of shares and in the meantime urged employees to invest their retirement savings in an already sinking Enron.

Example 2: WorldCom

The telecom titan WorldCom was once the second-largest long-distance telephone company in the US, riding high on the dot-com boom of the late 1990s. Its aggressive growth strategy and strong stock performance fascinated investors.

But in 2002, the firm admitted to improperly accounting for $11 billion in expenses and inflated earnings to mislead market players.

Similar to Enron, WorldCom’s stock price crashed, going from over $60 per share to pennies. The corporation filed for bankruptcy and later reemerged as MCI.

Both Enron and WorldCom scandals damaged investor confidence and caused big changes in regulations (Sarbanes-Oxley Act of 2002).

Why Do These Stories Matter?

They provide essential lessons, such as:

- Nothing Lasts Forever: Companies are constantly changing, and even those perceived as unshakeable can fall.

- Beware of Hype: Exuberance in the markets may lead to overvalued assets and blind investors to potential warning signs.

- Fundamentals Are a Constant in the Equation: A company’s long-term success depends on its products, services, management, competitive position, assets, liabilities, cash flow, and, of course, profits.

Example 3: Archegos

Another case that sent ripples through the capital markets was the collapse of Archegos in 2021.

Archegos was a highly leveraged private investment firm managing the wealth of a single, super-rich family. Ran by hedge fund manager Bill Hwang (convicted in July 2024), it amassed huge, concentrated positions in a handful of media and tech stocks.

The organisation used complex derivatives to amplify its bets without disclosing the full extent of their holdings.

This strategy shined for a while. The shares they heavily invested in, like ViacomCBS and Discovery, were performing well.

But in March 2021, ViacomCBS announced a secondary offering. This put downward pressure on the stock’s price, triggering margin calls for Archegos. So, they needed to offer more collateral to cover their leveraged bets.

As the company couldn’t do it, its lenders (major investment banks) began liquidating Archegos’s positions in a fire sale. Such a move flooded the market, causing their prices to plummet, inducing more margin calls, and resulting in a classic market panic.

Consequences

- Archegos’s Demise: The firm itself was wiped out, losing around $20 billion in a matter of days.

- Bank Losses: Credit Suisse alone reported a $4.7bn hit.

- Market Tremors: The abrupt collapse of this large player highlighted the hidden threats posed by excessive leverage and opaque commercial practices.

These examples remind us that even in a bull market, risks can lurk beneath the surface. While individual investors may not engage in such high-stakes leveraged trading, understanding these events and the dangers they expose is essential for navigating financial markets responsibly.

September: A Historically Challenging Month

September has earned the reputation as the stock market’s most volatile period. Throughout history, more major market crashes and corrections have occurred in September than in any other month.

Infamous “Septembers to Remember” that contributed to this status are:

1929: September marked the beginning of the legendary Wall Street Crash that ushered in the Great Depression. While the “Black Tuesday” took place in October, a steep decline in late September signalled the coming disaster.

1998: The collapse of Long-Term Capital Management (LTCM), a massive hedge fund, sent shockwaves through international markets and required a Federal Reserve-orchestrated bailout to prevent wider contagion.

2001: The 9/11 terrorist attacks occurred just as markets reopened after Labour Day, leading to a one-week shutdown.

2008: This month will forever be etched in financial history as the heart of the Global Financial Crisis. The downfall of Lehman Brothers, the rescue of AIG, and the near-collapse of numerous banks created panic and a prolonged downturn.

Why September? Theories, Not Certainties

There’s no definitive single reason this month has such a curse. Possible explanations include:

- End of Quarter: September closes the third quarter, a time when investors rebalance portfolios and fund managers might sell losing positions for tax purposes.

- Summer Lull Ending: Trading volumes often dip during the summer months and pick up again in September, amplifying price swings.

- Psychological Factors: Past crashes may create anxiety and a heightened sense of risk aversion.

While historical patterns are worth noting, they are not foolproof predictors of future performance. Timing the market based on the calendar alone is risky.

Key Takeaways

- Don’t Panic: Do not make rash decisions built on gone trends.

- Perspective: Market pullbacks are a normal part of investing. Stay focused on long-term goals and a well-diversified strategy.

- Research: Understand your risk tolerance, have a plan, and consult a professional if you need guidance.

Passive Investing is Outperforming Active Management

Analyses show that passive investing, which tracks indices like the S&P 500, often delivers better returns over time compared with active management (buying and selling to outstrip the market).

The hypothesis suggests that all known information is already priced into stocks, making it difficult for active managers to outperform consistently.

Passive Investing or Active Management? Advantages and Disadvantages

Let’s break down the differences between both and see which approach might be best for you:

Passive Investing (Indexing)

| Strategy | It mimics a specific market indicator, such as the S&P 500. |

| Goal | To match the market’s return, not to beat it. |

| How it Works | You’re essentially buying a diversified basket of assets (stocks, bonds) that makes up the index. |

| Lower Fees | Passively managed funds come with low expense ratios. |

| Clarity | It’s simple and suitable for beginners. |

| Historically Strong Performance | Index funds have consistently outperformed most actively managed funds over the long term. |

Active Management

| Strategy | Portfolio administrators trade based on research and market outlook to outperform the benchmark index. |

| Goal | To beat the market, seeking maximum rewards. |

| Potential for Big Returns | Skilled managers may generate above market earnings (though not guaranteed). |

| Tailored Portfolios | You customise your financial basket to suit specific money milestones. |

| Higher Fees | You’ll pay extra for this active management (even if it doesn’t bear fruit). |

| Complexity | It requires more monitoring and can be tougher during market fluctuations. |

So, What is the Top Choice?

There’s no one-size-fits-all answer. It depends on:

- Investment Goals

- Long-term growth with minimal effort? Passive.

- Seeking to maximise returns? Comfortable with more risk and elevated costs? Active.

- Risk Tolerance

- Lower risk tolerance? Passive.

- Higher risk tolerance (and potentially larger capital) with hopes of greater rewards? Active.

- Time Commitment

- A hands-off approach? Passive.

- Enjoy research and following the market? Active.

For most individual investors, passive investing in low-cost index funds or ETFs provides a solid foundation for long-term building.

Higher Risk Doesn’t Always Equal Higher Reward

Contrary to popular belief, taking on excessive risk might not lead to outsized gains. Check these three examples:

The Dot-Com Bubble (late 1990s – early 2000s)

Back then, investors piled into internet-related companies, many with unproven business models and little to no earnings, solely on the promise of future growth. This drove stock prices to unsustainable levels.

The bubble burst in 2000, leading to a sharp decline in technology stocks (the Nasdaq Composite Index fell close to 80%).

Investors who had poured money into high-risk companies without regard for fundamentals bore the brunt.

Emerging Market Investments

They offer the potential for higher returns due to faster economic expansion rates.

But they can be highly volatile and subject to political instability, currency fluctuations, and other risks that developed markets tend to be less vulnerable to.

Investing in the next big thing doesn’t guarantee consistent appreciation or profits.

Penny Stocks

Penny stocks are notoriously risky since they trade at low prices, and some are driven by speculation and rumours rather than sound fundamentals.

While a lucky few small-cap securities bets might skyrocket, the vast majority either go bankrupt or languish in obscurity, leaving investors with substantial losses.

Investing involves evaluating opportunities and managing risks, not chasing after unrealistic promises of big wins tied to exceptionally risky assets or strategies. A prudent approach is a diversified portfolio that includes a mix of low, medium, and high-risk investments.

The Domino Effect

Global markets are so connected that any big event in one place can affect stock prices and investor portfolios everywhere. Striking examples are:

The Asian Financial Crisis (1997-1998)

It began in Thailand, where a real estate bubble burst, leading to a currency crunch, confidence loss, and capital leaving the country.

This ran wild to other Southeast Asia nations (Indonesia, South Korea, Malaysia), where their stock exchanges tanked.

Global Impact

The fear extended to emerging markets worldwide, causing investors to flee, even if those economies were not linked to the original problem.

Remember ‘Long-Term Capital Management (LTCM)’? This American hedge fund needed a bailout in part due to wrong bets they’d made related to this crisis, revealing how interconnected finance had become.

The Global Financial Crisis (2008-2009)

This one started with the bursting of the US housing bubble. Easy credit, subprime mortgages (risky loans), and complex products spread the risk globally without much fanfare.

The investment bank’s collapse (Lehman Brothers’ Fall, September 2008) was a major domino. It was interconnected to so many institutions that it triggered a freeze in lending between banks – the lifeblood of the global economy.

Worldwide Recession

Virtually every large market globally saw huge declines, as did retirement accounts holding those investments, while countless countries entered severe recessions and spiked unemployment. As a result, government bailouts were needed.

What seemed like a US housing issue rapidly became everyone’s problem due to the complexity and interconnectedness of the financial system.

The Russian Invasion of Ukraine (2022-Present) and Its Global Fallout

When Russia invaded Ukraine in February 2022, Western countries sanctioned Russian oil and gas, causing energy prices to surge and hitting consumers and businesses.

Afterwards, a wave of inflation struck the US and Europe.

The war also disrupted wheat and fertilisers’ supply chains, leading to fears of a hunger crisis and increasing grocery costs. Such a black cloud affected food-importing countries the most.

To make it even worse, this event fed into an already fragile global economy grappling with post-pandemic logistics disruptions and monetary devaluation.

To fight inflation, central banks, including the US Federal Reserve, hiked interest rates, further affecting market sentiment.

Predicting any of these events is near impossible for mere mortals. Protect yourself with a diversified portfolio, a long-term outlook, and focus on what you can control, like your savings rate. Be aware of geopolitical risks, of course, but avoid making impulsive investments based only on what you read in headlines.

Key Takeaways

Knowledge is power. Understanding the intricacies of the stock market is vital for you as an investor, whether you are a beginner or a seasoned trader.

Look. Manipulative practices, historical pitfalls, and the truth behind common myths still resonate today, but by being aware of them, you can make more informed decisions. Stay vigilant, do your research, and remember that the key to successful investing lies in education and a well-diversified strategy.

Do you know any other secrets? Share them with us in the comments section.

2 thoughts on “Shocking Stock Market Facts Every Investor Needs to Know”