“Dear Lord, where has my money gone?” You might ask this every month, only to repeat the cycle.

We’ve all been there and suffered the consequences of exceeding our budget. But finally, a candle flickers in the dark. You can break free by unmasking 10 common ways of wasting money—and, more importantly, bring that to an end.

Ready to stop overspending for good? Here are our practical tips, no matter your income.

Today’s Focus of Attention is reader-supported. We sometimes include products we think are useful for our readers. If you buy through links on this page, we may earn a small commission.

1- Unused Subscriptions

Every month, these subscriptions take money from your bank account even if you don’t use them. Those amounts add up, though. Examples include:

| Streaming platforms (Netflix) |

| Fitness Apps |

| Magazine memberships |

| Amazon Prime |

How to Fix the Damage?

| Audit your bank accounts and check for recurring charges. |

| Cancel unused subscriptions. |

| Opt for annual payments, as they are cheaper than monthly ones (if you really need the service). |

Cancelling services you might use one day isn’t easy, but resubscribing is an option. Take a peek at this: spend three weeks without a service. If you can continue working, that’s a want, not a necessity. If it comes back to you, it’s yours. If it doesn’t, it never was, and it’s not meant to be.

2- Ignoring Energy Efficiency

What do we mean by that? Well, leaving lights on in broad daylight, using outdated appliances, or overlooking the importance of insulation. This deadly combination leads to high electrical bills.

How to Solve This Issue?

| Upgrade appliances to energy-efficient models with an ENERGY STAR rating. |

| Use smart thermostats and timers to optimise power consumption. |

| Seal your home to prevent draughts with weather stripping or insulation. |

Try for a month and notice the difference. Then decide what to do.

3- Impulse Purchases

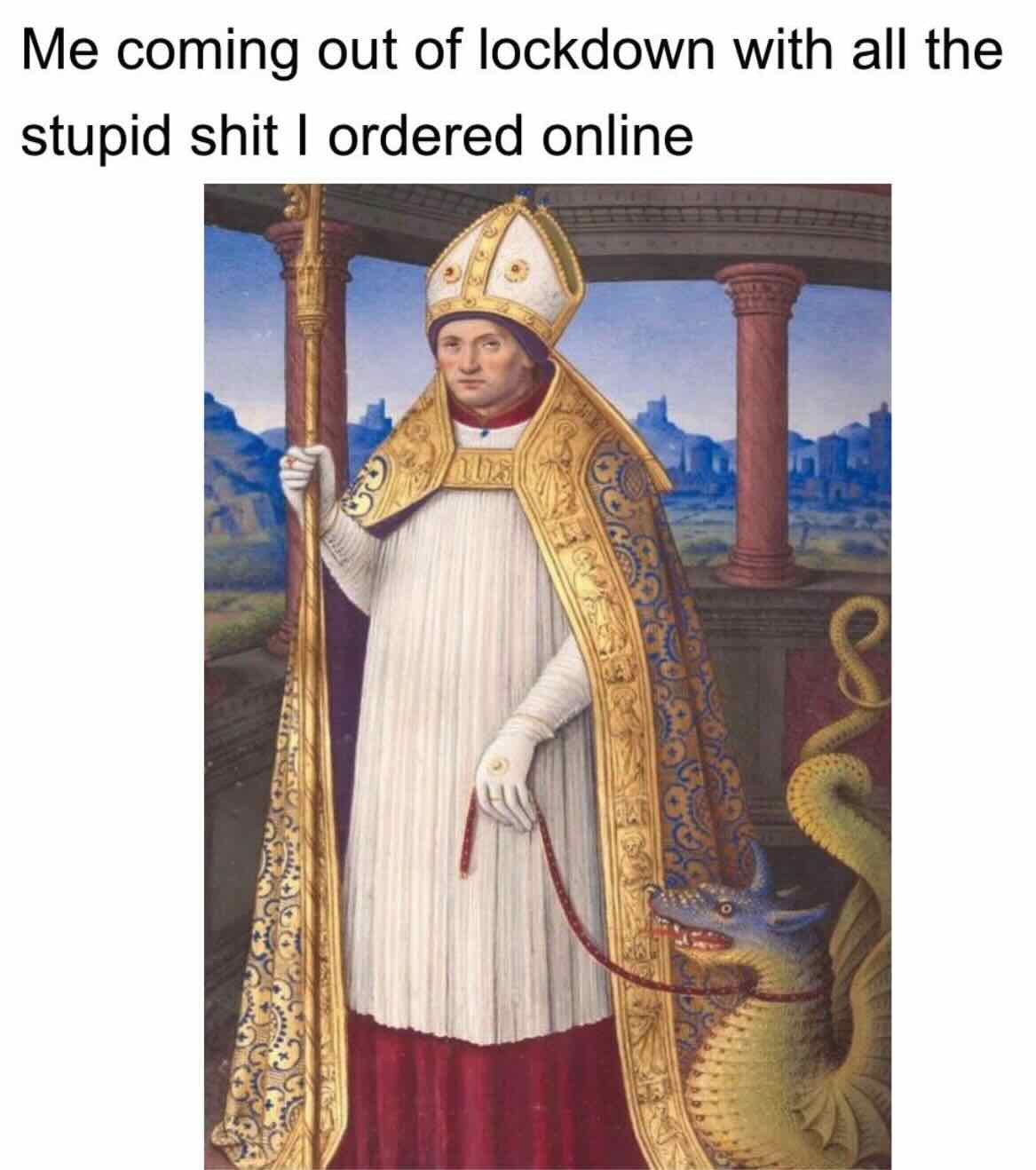

This is the incarnation of evil. Picture yourself scrolling on Amazon, checking for whatever to buy. You might end up like this guy:

Sudden splurges mount up. This happens the most with online stores’ one-click purchases. Moreover, impulsive shopping can become an addiction called ‘oniomania,’ like gambling or drug abuse.

How to Turn This Around?

| Before buying anything, wait for 24 or 48 hours for non-essentials. |

| Assign a monthly amount for discretionary spending. |

| Unsubscribe from retail emails to reduce temptations. Limit your exposure to sales and promotions. |

Above all, ignore that voice in your head whispering, “Only this time.” Do not sabotage yourself. This will sound hard, but impulsive buying leads to poverty. Do you know anyone who’s always out of cash, indebted, and eager to get his monthly pay cheque to pay his credit cards? Would you want to live like that?

4- Eating Out Too Often

The problem with this toxic habit lies in the cost, of course. Dining out or ordering takeaway is far more expensive than cooking at home. If you buy groceries and eat out four times a week, be honest and stop doing either of them. It makes no sense.

How to Dig Yourself Out of This Hole?

| Create a weekly meal plan. |

| Prepare meals in bulk (batch cook) and freeze portions for busy days. Speaking of which, you won’t look poor by doing that. |

| If you must eat at a restaurant, save it for special celebrations such as anniversaries or birthdays. And cash in on happy hour specials. |

Do not try to impress people by paying for a pricey dinner if your credit card is at its limit. Dine out if you can’t prepare a specific recipe at home. That said, why not expand your skills by learning how to prepare that dish yourself?

5- Neglecting Preventive Maintenance

Skipping routine maintenance on your house, car, or appliances leads to expensive headaches. Trust me, I learnt that the hard way.

A while back, I noticed a small leak coming from one of my toilets. It seemed harmless enough, so I brushed it off. Then, a couple of months later, I spotted a faint damp patch on the left wall of the kitchen. Within a week, that humble little stain ballooned into a major problem, demolishing about a square metre of the wall. It turned out that the culprit was that same neglected toilet leak. I never would have guessed such a minor drip could do such massive damage.

In the end, I had to strip off all the existing concrete, bring in professional plaster, apply cement, and basically rebuild a big chunk of the wall—costing me around £300. And yes, I cocked up. If I’d fixed the toilet right away, I would have saved myself both the financial hit and the hassle.

How to Skip Damages from Being Worse?

| Set reminders for regular check-ups. These include oil changes for your car, HVAC servicing, and gutter cleaning. |

| Learn basic maintenance such as replacing air filters or fixing leaky taps. |

| Invest in quality, durable items that need less frequent repairs. |

One slight issue can escalate into a problem; that problem can become a bad situation; and a string of bad situations soon spirals into a crisis. Avoid a crisis by keeping up preventive maintenance.

6- Overpaying on Insurance

You will spend more than necessary if you fail to compare insurance rates or bundle policies.

How to Sort It Out?

| Review quotes every year to ensure you are getting the best deal. |

| Combine home, car, and other policies for discounts. |

| Reevaluate your needs and remove unnecessary add-ons. |

Here are some to consider:

- Return to invoice

- Daily allowance

- Consumables

- Loss of belongings

- Named driver

- Rental car costs

- Better-car replacement

- Trip interruption

- Original equipment manufacturer

- Customised equipment insurance

7- Paying High Bank Fees

ATM fees, overdraft charges, and account maintenance fees can really sneak up on you, can’t they?

How to Fix It?

| Switch banks if yours is charging too much for its services. Seek out financial institutions or credit unions that offer free checking accounts. |

| Use in-network ATMs to avoid out-of-network fees. |

| Set up alerts for low balances to dodge negative balance charges. |

8- Keeping a Cluttered Closet and an Organised Larder

This might sound unimportant. But we often buy duplicates because we cannot track down our things. I’ve been a victim of such a disaster. Before I started organising my larder by category, I kept getting groceries I already had and the ones stored past their best-before date. That was a real waste of money.

How to Solve It?

| Declutter every month and donate or sell items you no longer use. Of course not with expired food. |

| Organise by colour or type to keep your wardrobe neat. |

| Stick to a list when buying clothes or groceries to steer clear of impulsive purchases. |

It’s wise not to go shopping on payday. And do not tour the supermarket when you’re hungry. You see the point here, don’t you?

9- Skipping Rewards and Cashback Offers

Missing out on these opportunities means leaving money on the table.

How to Make Things Work?

| Choose credit cards that offer points on purchases and use those benefits. |

| Sign up for loyalty programmes. Many retailers and services grant discounts for members. |

10- Letting Food Go to Waste

That is why you should have your larder organised. Disposing of unused groceries is throwing money in the rubbish bin.

How to Change This?

| Shop smart and buy only what you need. Also, plan meals around perishables. |

| Store in the right way. For instance, use airtight containers and proper techniques to extend shelf life. |

| Get creative and repurpose leftovers to minimise waste. |

Here are other tips to help you keep your money in place.

How to Avoid Falling Prey to Overspending

To start with, limit your exposure to temptations. Flee from window shopping or browsing e-commerce sites without a purpose. Do not buy just for the sake of spending.

Secondly, go cash-only. To curb squandering, pay in notes and coins instead of plastic.

Speaking of which, many people consider credit and debit cards a curse. I disagree, but they, no doubt, are open doors that let your money escape.

If you are the worst administrator ever, partner with a friend or family member. They can help you live within your means and control unnecessary spending.

In closing, create a monthly budget and stick to it. That’s what companies do. This is the only way.

Stop the Leaks, Start Saving, and Begin an Investment Journey

By far, these ten hidden money leaks affect your finances. If any of these signs sound familiar, don’t worry; take one small step to make a big difference. So, put them into action right away, not tomorrow. You will see your financial situation improve.

With the money saved, research any of these options:

| Mutual Fund |

| Index Fund |

| ETF |

| Gold |

| Real Estate Investment Trust (REIT) or any other tool. |

Do you have any other recommendations to save money and avoid irrational spending? Drop your thoughts to open a conversational arena. Don’t forget to share this post and remember that this site is reader-supported. So, support us to keep writing useful information.

4 thoughts on “10 Ways You’re Wasting Money (and How to Stop It)”